The world of Working Capital can be a volatile one for corporates of all sizes to navigate, and with ever-more uncertainty on the macroeconomic and geopolitical stage, it’s imperative for these businesses to both stay on top of emerging trends in this space, and perhaps most importantly, find solutions.

The events that have defined the last three years have had a significant impact on global trade. In this blog, we review some of the major trends that are impacting global supply chains and Working Capital requirements.

After a period of relative stability in 2023, characterised by limited raw materials and core component shortages and minor logistic issues, supply chain disruptions have once again come to the fore, driven by various factors such as extreme weather conditions and geopolitical tensions.

Geopolitical tensions are expected to be a key factor in global trade in 2024, and there are increasing concerns about the long-term impacts of climate change on global supply chains.

Nearshoring has also gained considerable attention as a strategic choice for businesses seeking to optimise their supply chain operations.

Within this article we also look at changes in consumer behaviours, including the rising trend of ‘doing rather than having’ and the shift from traditional ownership-centric models to a subscription-based approach: Everything-as-a-Service.

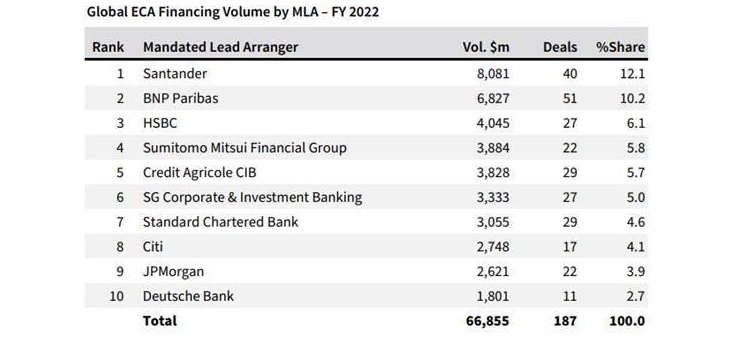

Bart Timmermans, European Head of Global Transaction Banking (GTB) at Santander CIB, said: “Despite all global disruptions and the impact on trade flows, Santander CIB continues to create new solutions to support our clients during the business transformations they go through. We have examples in all sectors, from automotives to batteries, or consumer goods to retail, in helping our clients to optimise their supply chains.”

Here are five key trends impacting Working Capital in 2024:

Supply chain disruption is back

Supply chain disruptions appeared to be fading in the rear-view mirror last year, as things returned to some form of normality following the pandemic – the cost of shipping, delays, availability of raw materials and other key indicators had returned to pre-pandemic levels. Now, in 2024, supply chain disruption is back to the top of the agenda, for a variety of reasons, including extreme weather events and geopolitical instability.

The impact of geopolitical instability

Geopolitical instability has emerged as a critical factor significantly impacting the complex network of global supply chains. The Ukraine-Russia war first and the more recent Middle East conflict are having notable impacts on commercial trade.

Aside from the increase in oil & natural gas prices, and war risk insurance premiums, companies have been obliged to face higher costs and time to reroute cargos away from dangerous areas, thus continuing to add significant issues to supply chains.

Carriers have already diverted more than $200bn in trade from the Red Sea, adding about 6,000 miles to a typical journey from Asia to Europe and on average three or four weeks on product delivery times.

The impact of weather

Everstream Analytics’ annual risk outlook ranks extreme weather as the biggest threat to global supply chains in 2024. These extreme weather events are becoming increasingly common, placing further pressure on supply chains.

Floods, droughts, and other extreme weather conditions are becoming a recurrent issue both in Europe and the US, hammering ports, highways and factories on a global scale.

Low water levels hitting shipping capacities – for example at the Panama Canal and Rhine River - violent storms disrupting automotive industries and heatwaves & droughts affecting European agriculture (namely Spanish olive production) are just some of the ways climate change is playing a part in this Working Capital headache.

It’s true that supply chain disruptions caused by COVID-19 are largely a thing of the past, however, ensuring resilience levels remain high in order to counter the increasing threat of climate change should become a top priority, with options including diversifying source locations and investing in climate-resistant locations.

To ensure a better measurement of GHG emissions across the entire value chain, companies have started embedding sustainability criteria in their Working Capital solutions. Sustainability-Linked Supply Chain Finance, for example, represents one of the best-established WC solutions increasingly requested by companies to combine the typical financial benefits of SCF with scope 3 emissions reduction targets.

Nearshoring – the trend of shortening supply chains

After a period of turmoil, many companies are looking to shorten their supply chains to reduce reliance on foreign suppliers, in a bid to increase business resilience.

In Europe, there has been a 29% increase in demand for industrial space, driven in large part by manufacturing and logistics – an example of this being Mercedes-Benz and BMW both announcing plans to open new production plants in Europe, as part of their long-term electrifying strategy, with lower labour, transportation and energy costs cited.

While these decisions are often viewed, rightly, as bringing production closer to end-customers, nearshoring may also represent a key priority in a company’s sustainability agenda to reduce carbon emissions related to long-distance material transportation.

The proximity to local markets, faster delivery times and improved responsiveness to customer demands will only see nearshoring usage increase in the years ahead.

From a Working Capital Management standpoint, Supply Chain Finance (SCF) represents a core solution to support companies to engage with new suppliers and secure adequate payment terms to avoid increases in Working Capital requirements. Companies can leverage SCF to establish solid relationships with new suppliers, reduce procurement-related risks and potentially embed a sustainability-link, reducing scope 3 emissions.

From just-in-case to just-in-time

Higher borrowing costs and inflation levels have led to many corporates investing resources in inventory reduction.

It’s been reported by S&P that, since the end of 2022, global companies have been heavily reducing the quantity of inputs purchased, as well as stocks of raw materials and finished goods. In the S&P report, they noted how finished good purchasing had been on the downturn for 13 consecutive months, while finished good levels were cut for eight of the last nine months.

This has been mirrored on the production side to mitigate risks of maintaining high levels of finished goods.

The impact of this reduced consumer demand – and as a result destocking trend – has been noticeable.

Within the chemical sector, many global players have reported notable losses, both in Europe and the US.

The consumer industry has also, unsurprisingly, felt the strain of reduced demand, although this isn’t an all-encompassing problem, with some companies experiencing a share price uptick in the first quarter of their 2023 fiscal year, thanks a notable cut of inventories.

From a financial perspective, the de-stocking trend is expected to have a notable impact on Days Inventory Outstanding (DIO) and, more broadly, on Working Capital requirements. The return to the just-in-time approach is helping companies to reduce the levels of inventory, both for raw materials and finished goods, and decrease the time of goods on the shelf.

“Doing rather than having” – where do consumers’ priorities lie?

One major shift in consumer behaviour since the pandemic has come in the shape of prioritising experiences over material goods, characterised by high inflation and rising interest rates.

The events industry, for instance, has seen significant growth over the last few years, and this is forecast to continue over the next few years, becoming a $2.1tn industry by 2032.

Look too at industries selling experiences – travel, leisure, entertainment – who have benefitted from a 25% rise in sales in 1Q2023. From a Working Capital perspective, companies operating in these sectors have experienced a notable increase in sales, with a consequent 10 day reduction of Cash Conversion Cycle over the last two years, mainly driven by a reduction in Days Sales Outstanding (DSO).

Conversely, several other industries are now reporting a more negative outlook thanks to consumers cutting back on certain types of discretionary spending; the purchase of food and beverages has declined by approximately 5% since 1Q2021, with home cooking giving way to eating out in restaurants. With higher levels of unsold goods on the shelves, companies are increasingly exposed to report again higher inventory levels, increasing the importance of Working Capital management.

A shift from ownership-centric models to a subscription-based approach

The concept of Everything as a Service (XaaS) has revolutionised the way businesses operate, representing a fundamental shift from traditional ownership-centric models to a more versatile subscription-based approach.

Software as a Service (SaaS) or Equipment as a Service (EaaS) are established examples, although with more cutting-edge technology destined to emerge, this umbrella will only expand.

The global XaaS market size was valued at approximately €550bn in 2022, yet is projected to reach a market value of €3tn by 2030.

The possibility of accessing strategic assets without balance sheet implications represents the main driver behind the growing demand for solutions. Moving from a Capex-intensive model to an Opex focused scheme - whereby companies will not be requested to immobilise significant amounts of resources on a single asset - can maintain access to core production facilities without impacting financial and working capital ratios.

Beyond the financial benefits, XaaS is also helping companies re-adjust their operating models by improving their agility, so they can adapt their business to evolving market dynamics quickly and scale operations seamlessly.